Discover Your HELOC Potential: Get Pre-Qualified in Just 5 Minutes!

Apply online and receive immediate options

Unlock up to $400,000 of home equity

Skip the appraisal process

View your offers with a soft credit check

Access funds in as little as 5 days

Qualify with rental income (Investment properties)

FICO down to 640

Call Now

Here are several ideas for using HELOC funds:

1. Home renovations or improvements

2. Debt consolidation

3. Education expenses

4. Emergency fund

5. Investments in stocks or real estate

6. Starting or expanding a business

7. Vacation or travel expenses

8. Medical expenses or healthcare costs

9. Wedding or special events

10. Vehicle purchase or repairs

Fixed Rates

Your interest rate will stay the same until you pay off the draw.

Funds in 5 Days

Have your cash in hand in 5 days

Borrow up to $400K

Borrow up to $400,000 with a one-time origination fee

Apply online

Apply online with little to no paperwork needed

Apply online with limited documentation and no in person appraisal

Want to speak with a Licensed Loan Officer?

Schedule a phone or zoom consultation.

AXEN Home Equity Line is available in AK, AL, AR, AZ, CA, CO, CT, DC, FL, GA, IA, ID, IL, IN, KS, LA, MA, MD, ME, MI, MN, MO, MS, MT, NC, ND, NE, NH, NJ, NM, NV, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VA, VT, WA, WI, WY with more states to come. Equal Housing Opportunity. This site is not authorized by the New York State Department of Financial Services. No mortgage solicitation activity or loan applications for properties located in the State of New York can be facilitated through this site. AXEN Lending LLC is a wholly-owned subsidiary of AXEN Technology Solutions, Inc., a financial technology company.

The AXEN Home Equity Line is an open-end product where the full loan amount (minus the origination fee) will be 100% drawn at the time of origination. The initial amount funded at origination will be based on a fixed rate; however, this product contains an additional draw feature. As the borrower repays the balance on the line, the borrower may make additional draws during the draw period. If the borrower elects to make an additional draw, the interest rate for that draw will be set as of the date of the draw and will be based on an Index, which is the Prime Rate published in the Wall Street Journal for the calendar month preceding the date of the additional draw, plus a fixed margin. Accordingly, the fixed rate for any additional draw may be higher than the fixed rate for the initial draw.

Approval may be granted in five minutes but is ultimately subject to verification of income and employment, as well as verification that your property is in at least average condition with a property condition report. Five business day funding timeline assumes closing the loan with our remote online notary. Funding timelines may be longer for loans secured by properties located in counties that do not permit recording of e-signatures or that otherwise require an in-person closing.

To check the rates and terms you qualify for, we will conduct a soft credit pull that will not affect your credit score. However, if you continue and submit an application, we will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit.

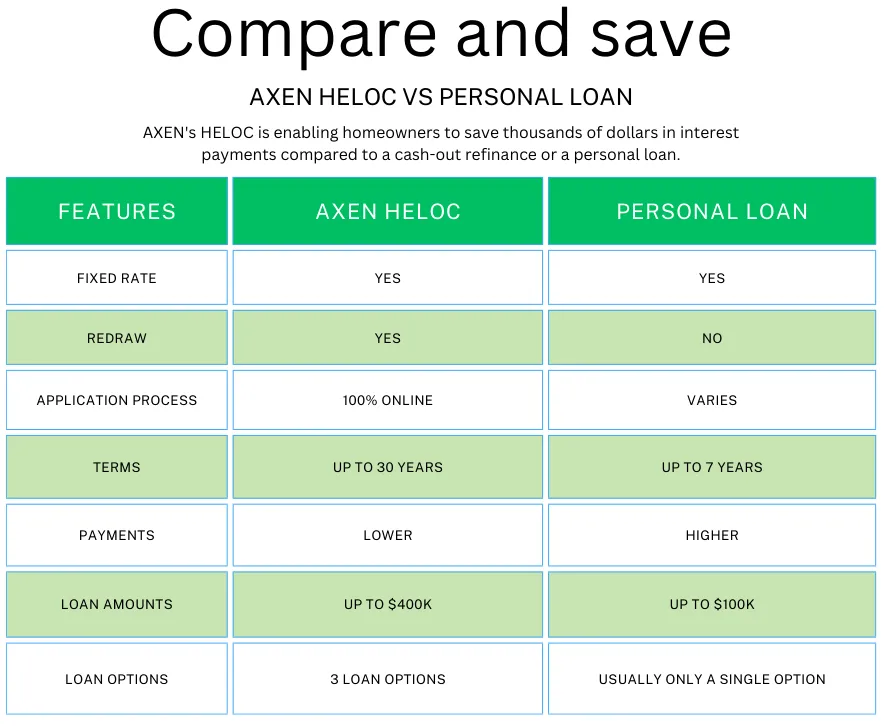

An AXEN HELOC is secured with your home as collateral, whereas personal loans and credit cards are not.

Our loan amounts range from a minimum of $15,000 to a maximum of $400,000. For properties located in AK, the minimum loan amount is $25,001. Your maximum loan amount may be lower than $400,000, and will ultimately depend on your home value, lien position, credit profile, verified income amount, and equity available at the time of application. We determine home value and resulting equity through independent data sources and automated valuation models.

Available APRs range from 7.80% to 17.20%, which includes the payment of a higher origination fee in exchange for a reduced interest rate, which is not available to all applicants or in all states. The lowest APRs are only available to the most qualified applicants, depending on credit profile and the state where the property is located, and those who also select five year loan terms; APRs will be higher for other applicants and those who select longer loan terms. Your actual rate will depend on many factors such as your credit, combined loan-to-value ratio, loan term, occupancy status, and whether you are eligible for and choose to pay a higher origination fee in exchange for a lower rate. Rates change frequently so your exact APR will depend on the date you apply. APRs for home equity lines of credit do not include costs other than interest. You will be responsible for an origination fee of up to 4.99% of your initial draw, depending on the state in which your property is located and your credit profile. You may also be responsible for paying the costs of valuation if an AVM is not available for your property ($180), manual notarization if your county doesn’t permit eNotary ($380), and recording fees ($0 - $315) and recording taxes, which vary by state and county ($0-$1,400 per one hundred thousand dollars borrowed). Property insurance is required as a condition of the loan and flood insurance may be required if your property is located in a flood zone. You should consult a tax advisor regarding the deductibility of interest and charges to your AXEN Home Equity Line.